We got a piece of real first class mail from the bank that holds our mortgage a few days ago. They wanted us to know we were a few grand past due on our real estate taxes.

We got a piece of real first class mail from the bank that holds our mortgage a few days ago. They wanted us to know we were a few grand past due on our real estate taxes.

Say what?

Yesterday they followed up with a phone call. You know they were serious, the CSR was here in the states.

It’s all true. The Foxes who’ve never once had a credit ding of any type (because I am not allowed to handle money) were 90+ days behind on our property taxes.

You’ve got to follow this closely, because it makes no sense. The tax collector doesn’t change the address for tax bills at the time a property is sold. It happens all at once, once every year.

I called the tax collector’s office in Santa Ana to straighten things out.

“Parcel number, please?”

The woman on the other end of the phone couldn’t use my address to find it. I was instructed to call the tax assessor’s office.

Back to the tax collector, now with the parcel number. Everything was explained. We’re good now.

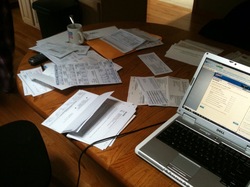

I’m looking at the original pages that came in the mail. They’re marked up with names, numbers and notes. The arrows I’ve drawn since high school, maybe earlier, are scattered on the page. This could pass for 1968 Geoff down to the doodles.

The check, including the next property tax installment, is in the mail. It was suggested, if I requested the county would offer clemency on any penalties or interest. This must happen a lot.